The 70% Rule For Real Estate Investors Is DEAD In 2022

Yesterday, I had a private coaching call with an investor that I personally coach. As usual, we were reviewing his leads and deals.

On this call, we focused heavily on what to offer sellers for their house.

He had just made five offers and every seller told him no.

This investor was using the standard buying formula.

ARV (After Repair Value) X 70% - Repairs = MAO (Max Allowed Offer)

I think, at one point, we have all been taught the 70% rule and that it’s a great formula for making offers!

Well, NOT IN THIS HOT MARKET!!!

To take the eyes off my coaching student, who actually had 4 GREAT deals, but made the wrong offer, I will show you a deal that I put under contract this week. I'll share what I offered and how I arrived at that offer.

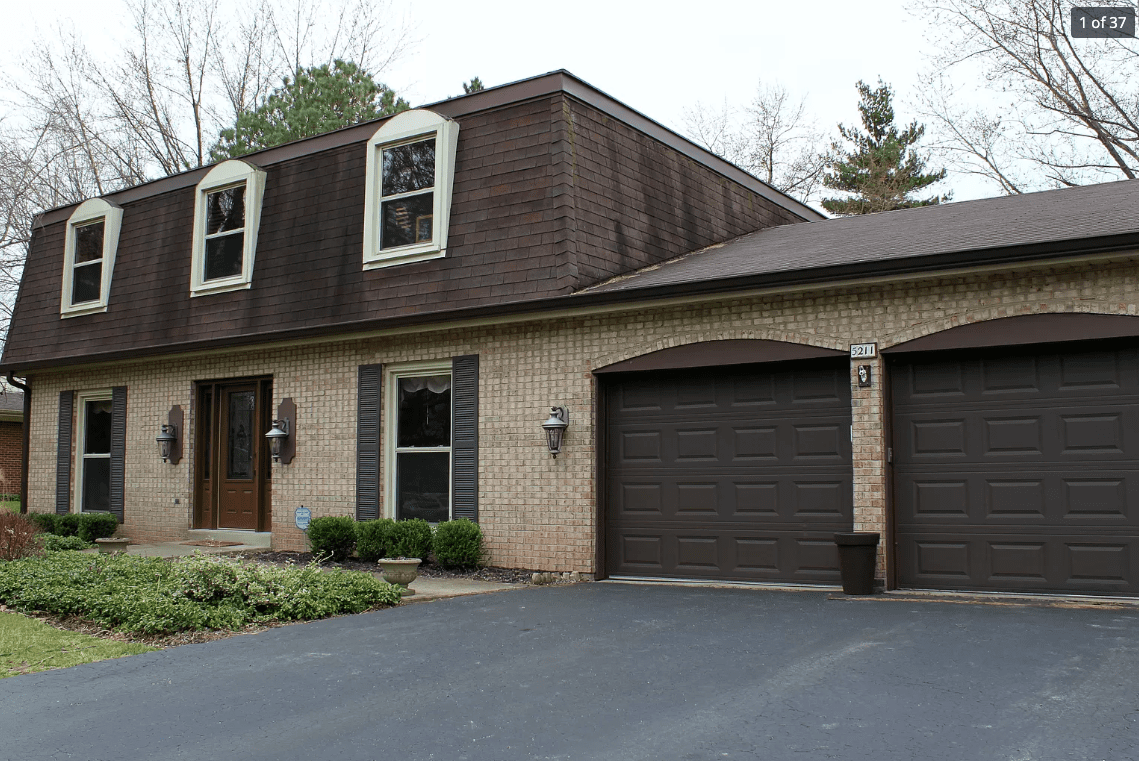

About a week ago, a seller filled out a form on my website www.DaytonPrivateCapital.com saying that they were interested in selling their home.

Located At 5211 Beaconwood Ct. Dayton, Ohio 45429

I went to the appointment and viewed the home with the owner. Prior to the appointment, she had told me over the phone that she wanted $270,000 for the house.

The home did need some work, but not much. For the most part, it was in AMAZING shape. The biggest issue was that the kitchen was outdated. That’s it.

I asked her, "Why did you fill out a form to sell your house to an investor rather than just listing it with a Realtor?"

She told me what most do.

"I don’t want to pay a Realtor, and she also is moving to Portugal so needed to sell rather quickly."

Zillow has the value of this home at $331,900

https://www.zillow.com/homes/5211-Beaconwood-Ct-Dayton,-OH-45429_rb/35046971_zpid/

Systemate has the value of this home at $315,100.

The homeowner had just bought this house in 2016 for $224,500.

I established the ARV on this house at $320,000.

After I viewed the house, the seller and I sat down to talk numbers. She told me that she really didn’t think she could get $270,000 out of the house and just wanted a win/win and a quick sale.

I made her two offers…

1st offer was a subject to offer.

I would pay her $50,000 down, take over her existing loan where she owed $190,000 on the house, continue to make her $1,574 payment (Including taxes and interest) and the loan would balloon in 60 months where I would have to pay her off. This would give her around $240,000 for the house over time.

The 2nd offer was a straight sale of me buying the house outright for $225,000 with a 30 day close and no inspections.

It’s pretty common for me to make a seller two offers, allowing them to choose what fits them best.

She got back to me after speaking with her husband, and didn’t want to even discuss the subject to offer any further. She also said that she didn’t want to take $225,000 for the house because it was just $500 more than what they paid for it in 2016.

She told me she needed $240,000 for the house and wouldn’t take a penny less.

I agreed to up my offer to $240,000 and it’s currently under contract. I’ll tell you what I’m going to do with it later.

This 70% MAO offer formula and this crazy hot (but cooling down) real estate market just aren't compatible.

Here would have been the numbers had I stuck with the 70% formula.

ARV = $320,000

70% of ARV = $224,000

Repairs = $20,000

Total offer price = $204,000

No way would she even accept that offer, or even consider it. My coaching student from earlier faced the same issue, his offers were just too low for this market.

I ditched the 70% rule a couple years ago and even ditched my own formula that I created for my own business.

My Formula USED TO BE ARV X .5 - $10,000 = MAX OFFER

I promise, I would be left without a deal all year if I was sticking to those figures.

So what do I do in this crazy real estate market?

I go with the “Does it make sense” math.

I establish ARV first and find out what the seller is selling for. Then, I see if it’s got the wiggle room in it that I need to do the deal and have it make sense for our company.

I’m buying deals at 80% ARV. The deal on 5211 Beaconwood Ct. we’re buying at 73% of the ARV. We will be all in at 83%

I know many investors that are doing the same and still making A TON of money in this crazy market that we are all in.

If you’re having trouble getting sellers to accept your offers right now, you really want to take a look at this approach as it’s likely your problem.

If you’re scared and don’t know what to offer right now, this should help you too.

Unfortunately right now, we’ve ditched all formulas and moved to a “Does the deal make sense” only model.

Lastly, when the market changes, you must change your systems with it. You cannot expect results if you use the same systems for every real estate market we encounter.

To The Top,

John Cochran

Systemate Founder

Real Estate Investor

"Priceless!!!" ~ Tossie Griner

"Priceless!!!" ~ Tossie Griner

I am confused. It seems like you did in a way use to 70% rule by using 73%. ARV ($320,000) X 73% = $233,600 – Repairs ($20,000) = $216,200. So, how did you come up with an offer of $225,000 which she refused? You agreed to her price of $240,000. What was your exit strategy?

I’m not using 70% rule right now in this market. It’s too nuts. We bought at 240K and just sold it for 285K to a retail buyer

Very informative! Looking forward to working closely with Systemate over the next several years!

thanks John I deal with commercial multi family

were can I get financing for this mao?